Does it matter?

|

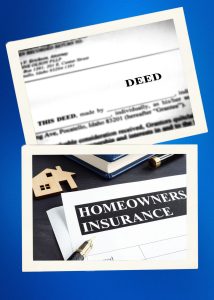

The example was that the Deed to the home was held in the “Smith Family Trust” – very common and a recommended tool for tax and survival purposes. When a Real Property transfers ownership, at transfer the title company will always ask the buyers, new owners, “how do you plan to hold title?”. Some common ways to hold title are as Community Property, Joint Tenancy, or in a Trust. These and other forms of title can have big implications with your taxes, business ownership and especially rights of survivorship. Once the property has transferred title, and the Deed has been recorded at the county, it is common for owners to transfer the property into a Trust. It’s not required, and sometimes it’s not necessary, but it’s a good thing to do your homework on. Holding property the right way legally will prevent the Probate process should something happened to BOTH owners at the same time, or if the right of survivorship has not been detailed in a Trust. I do A LOT of Trust sales as I work with a lot of seniors. But that is a different kind of “Trust”, that is when there is an executor of an estate because the owner has passed away. |

|||

|

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Boy does it ever!! It recently came to our attention that after the devastating fires in Southern California, insurance carriers were declining claims because the property was held in Trust, but the policy was held by the individual owners.

Boy does it ever!! It recently came to our attention that after the devastating fires in Southern California, insurance carriers were declining claims because the property was held in Trust, but the policy was held by the individual owners. Why does it matter? Because these insurance companies are claiming that they are insuring the individuals, “Bob and Sue Smith”, while the home is actually held by the “The Smith Family Trust”! Are you kidding me? Unfortunately, not – we all know insurance companies will do everything in their power to NOT pay out claims – it’s part of their business strategy. Personally, I don’t think this will stand up to the first law suit it faces, or that the California Department of Insurance will allow this to stand for very long. But for now – we are being told in a loud voice to give our clients and sphere of influence a big heads up that the name(s) on your real property deed, and the name(s) on your insurance policies need to match.

Why does it matter? Because these insurance companies are claiming that they are insuring the individuals, “Bob and Sue Smith”, while the home is actually held by the “The Smith Family Trust”! Are you kidding me? Unfortunately, not – we all know insurance companies will do everything in their power to NOT pay out claims – it’s part of their business strategy. Personally, I don’t think this will stand up to the first law suit it faces, or that the California Department of Insurance will allow this to stand for very long. But for now – we are being told in a loud voice to give our clients and sphere of influence a big heads up that the name(s) on your real property deed, and the name(s) on your insurance policies need to match.